- Joined

- Oct 9, 2025

- Messages

- 38

Forex, short for foreign exchange, is the global marketplace where currencies are traded. Think of it as the world’s biggest financial market bigger than stocks, bigger than bonds with over $7 trillion traded daily.

Currency prices change all the time because of things like:

Core concepts you must know (no shortcuts)

Pairs are grouped into:

Knowing lot sizes is crucial because your risk per trade is calculated using pip value × number of pips you’re willing to risk.

Margin is the required deposit to open a position. Example:

Important: High leverage magnifies profits and losses. One wrong move with high leverage can blow up an account fast.

Key tip: always plan SL and TP before entering a trade. This is risk management 101.

Important concept: in Forex, you can profit from falling markets. You don’t need to “own” the currency; you’re trading price movements.

Why Currencies Move

1. Economic Indicators

Strong economic data usually strengthens a currency; weak data weakens it.

2. Interest Rates & Central Bank Policy

Higher interest rates attract foreign investment → currency appreciates.

3. Inflation Expectations

4. Political Stability & Geopolitical Events

5. Market Sentiment & Risk Appetite

6. Speculation & Trader Positioning

7. Supply and Demand for Currencies

8. Commodity Prices (for commodity-linked currencies)

9. Technical Factors

10. Unexpected Events (Black Swans)

Summary: The Forex Market Never Sleeps

The forex market operates 24/5, with overlapping sessions (Asia, Europe, North America). Prices react instantly to:

When and Where Forex Happens

Forex doesn’t have a single building or market like the stock exchange. It happens online, between people, banks, and companies all over the world. You just need an internet connection and a trading platform that’s your access to the market.

When it Happens

Forex is open 24 hours a day, five days a week. It starts on Monday morning in Asia and keeps moving around the world until Friday night in the U.S.

Think of it like a relay race when one region finishes trading, another one starts. That’s why the market almost never sleeps.

Here’s how it moves through time zones:

The busiest time is when London and New York sessions overlap around 4 PM to 8 PM EAT. That’s when prices move the most, and traders find the best opportunities.

Where it Happens

There’s no single location. Forex trading happens:

How Forex Trading Actually Works

At its core, forex trading is buying one currency and selling another at the same time because currencies are always traded in pairs.

For example:

When you trade EUR/USD, you’re comparing the Euro against the US Dollar.

Who’s Involved in Forex

How You Make Money

Let’s say:

Most traders use MetaTrader 4 (MT4) or MetaTrader 5 (MT5) they’re free, popular, and work on phones, laptops, or browsers. Your broker usually gives you a download link when you open an account.

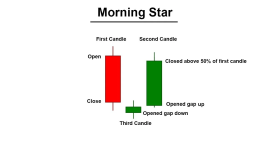

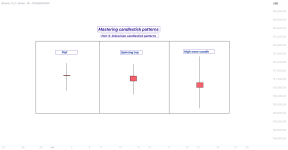

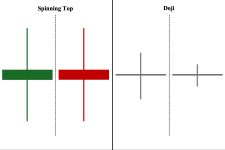

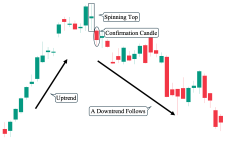

1. Chart Window

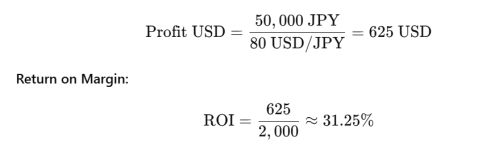

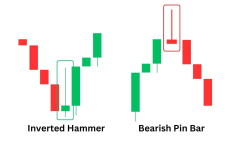

This shows how a currency’s price moves over time. Each “candle” or “bar” represents a time period could be one minute, one hour, or one day, depending on your setting.

You use charts to spot trends and decide when to buy or sell.

2. Market Watch

This small list shows currency pairs and their current prices.

Example:

The first number is the sell price (bid), and the second is the buy price (ask). The tiny difference between them is the spread that’s your broker’s small fee.

3. Terminal or Trade Tab

Here you see your open trades, account balance, profit/loss, and trade history. It’s basically your dashboard.

4. Order Panel

This is where you place new trades. You’ll choose the pair, trade size, whether you want to buy or sell, and set your Stop Loss (SL) and Take Profit (TP) levels before confirming.

That’s it. You’ve opened your first trade. You can close it anytime manually or let the platform close it automatically when it hits your SL or TP.

Shorter timeframes show quick price moves. Longer ones show the bigger picture. Most beginners start with H1 or H4 it’s calmer and clearer.

YOU CAN USE TRADING VIEW SOFTWARE FOR BETTER VIEW DOWNLOAD TRADING VIEW

Use it to learn:

Stay on demo until you feel comfortable using every part of the platform with your eyes closed.

1. What Forex Really Is

At its core, Forex trading means buying one currency while selling another. Currencies always move in pairs, like:- EUR/USD (Euro vs US Dollar)

- GBP/JPY (British Pound vs Japanese Yen)

If you believe the Euro will rise against the Dollar, you buy EUR/USD. If you think it’ll fall, you sell it. That’s the entire idea.

Forex = buying one currency and selling another at the same time. You trade pairs. Your job is to predict direction of that pair. Everything else (platforms, orders, risk rules) supports that decision.

Currency prices change all the time because of things like:

- Economic news (jobs, inflation, etc.)

- Central banks changing interest rates

- Political events or big world news

- How confident traders feel about the market

You make money if you predict the direction right . buy when it’s cheap, sell when it’s high, or the other way around.

Core concepts you must know (no shortcuts)

Currency Pair (Base/Quote)

Every Forex trade involves two currencies. The first is the base, the second is the quote.- EUR/USD 1.1000

- Base = EUR

- Quote = USD

- This means 1 euro costs 1.1000 dollars.

Pairs are grouped into:

- Major pairs – most traded, include USD (EUR/USD, GBP/USD, USD/JPY)

- Minor pairs – no USD involved (EUR/GBP, EUR/JPY)

- Exotics – one major + one emerging market currency (USD/TRY, USD/ZAR)

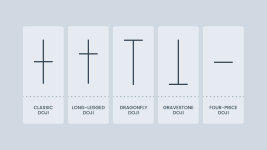

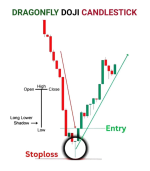

Price Movements & Pips

A pip is the smallest standardized movement in a pair.- Most pairs: 0.0001

- JPY pairs: 0.01

Why it matters: profits/losses are measured in pips, which are then converted to currency value depending on your lot size.

he Japanese yen (JPY) is quoted with only two decimal places in forex pairs like USD/JPY because its value per unit is much lower than that of most major currencies. For example, one U.S. dollar is worth around 150 yen, compared to about 1.08 euros or 1.27 pounds. To keep price movements meaningful and consistent, a "pip" the smallest standard price change is defined as 0.01 for JPY pairs (e.g., 150.00 to 150.01), rather than 0.0001 as used in EUR/USD or GBP/USD. Using four decimals for JPY would make a single pip far too small (0.0001 JPY), resulting in tiny, impractical changes that don’t align with how traders measure profit, loss, or risk across different currencies. Other low-value currencies follow the same two-decimal convention, including the Hungarian forint (USD/HUF, e.g., 360.50), South African rand (USD/ZAR, e.g., 17.85), and Thai baht (USD/THB, e.g., 33.40), where one pip equals 0.01 due to their small unit values.

This two-decimal convention for JPY and similar currencies is a long-standing market standard rooted in each currency’s relatively low unit value and historical pricing practices. It ensures that a one-pip move carries a reasonable dollar value typically $6–10 per $100,000 traded similar to other major pairs despite the exchange rate difference. While some brokers now display JPY and other two-decimal pairs with three decimals (e.g., 150.123 or 360.505) for extra precision, the official pip remains the second decimal place. In short, the number of decimals isn’t arbitrary it’s designed to maintain clarity, consistency, and practicality in global forex trading, and this logic applies equally to JPY, HUF, ZAR, THB, and other low-unit currencies.

Lot Sizes

A lot determines the trade size.- Standard lot = 100,000 units of base

- Mini lot = 10,000 units

- Micro lot = 1,000 units

Knowing lot sizes is crucial because your risk per trade is calculated using pip value × number of pips you’re willing to risk.

Leverage & Margin

Leverage lets you control large positions with a small deposit.- Leverage 1:100 → $1 controls $100

- Leverage 1:500 → $1 controls $500

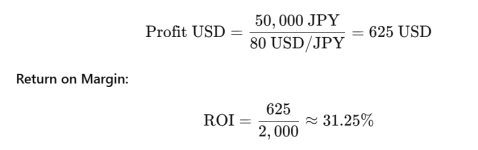

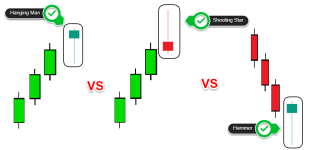

Margin is the required deposit to open a position. Example:

- You want to open 1 standard lot EUR/USD (100,000 EUR)

- EUR/USD = 1.1000

- Account in USD, leverage 1:100

- Margin = 100,000 × 1.1000 ÷ 100 = $1,100

Important: High leverage magnifies profits and losses. One wrong move with high leverage can blow up an account fast.

Spread

Spread = broker’s cost. It’s the difference between bid (sell) and ask (buy) prices.- EUR/USD: Bid = 1.1000, Ask = 1.1002 → spread = 2 pips

- You start a trade slightly in negative, since the pair must move enough to cover the spread.

Order Types

Forex offers flexibility to enter/exit positions.- Market Order – buy/sell immediately at current price

- Limit Order – buy below current price, sell above current price

- Stop Order – buy above current price, sell below current price (used for breakout trading)

- Stop-Loss (SL) – automatically closes a losing trade to limit risk

- Take-Profit (TP) – automatically closes a winning trade at target

Key tip: always plan SL and TP before entering a trade. This is risk management 101.

Going Long vs Short

- Long (buy): expect price to rise

- Short (sell): expect price to fall

- Buy → price rises to 1.1050 → profit

- Sell → price falls to 1.0950 → profit

Important concept: in Forex, you can profit from falling markets. You don’t need to “own” the currency; you’re trading price movements.

Additional Core Concepts

- Volatility

Measures how fast a pair moves. High volatility = big swings, more opportunities but more risk. - Liquidity

How easy it is to buy/sell a currency without affecting the price. Major pairs = highly liquid, exotics = low liquidity. - Swap/Overnight Interest

If you hold a position overnight, you may pay or earn interest due to different currency rates. - Risk/Reward Ratio

- Decide before trade: “I’m risking 50 pips to make 100 pips → 1:2 ratio”

- Helps protect your account from blowing up

- Correlation

Some pairs move together (EUR/USD & GBP/USD), some opposite (USD/CHF vs EUR/USD). Awareness helps in risk management.

Here’s what this really means: mastering Forex is not just about knowing the definitions, it’s about how these elements interact. Leverage without understanding pips and margin is dangerous. Spreads eat profits if ignored. Risk management is the only way to survive long term.

Why Currencies Move

1. Economic Indicators

Strong economic data usually strengthens a currency; weak data weakens it.

- GDP growth

- Inflation (CPI, PPI)

- Employment data (e.g., Non-Farm Payrolls in the US)

- Retail sales

- Industrial production

- Trade balance (exports vs. imports)

Higher interest rates attract foreign investment → currency appreciates.

- Decisions by central banks like:

- Federal Reserve (Fed) – USD

- European Central Bank (ECB) – EUR

- Bank of Japan (BOJ) – JPY

- Bank of England (BOE) – GBP

- Forward guidance and rate hike/cut expectations move markets even before decisions.

- High inflation → pressure to raise rates → stronger currency

- Low or deflation → possible rate cuts → weaker currency

- Elections, government changes, trade wars, sanctions, or conflicts can cause sudden volatility.

- Example: Brexit → GBP plunged due to uncertainty.

- Risk-on: Investors favor high-yield currencies (AUD, NZD, emerging markets)

- Risk-off: Flight to safe-haven currencies (USD, JPY, CHF)

- Large hedge funds, banks, and retail traders betting on trends.

- Carry trades: Borrowing in low-yield currencies (e.g., JPY) to invest in high-yield ones (e.g., AUD).

- Trade flows: Countries exporting more earn foreign currency → demand rises.

- Capital flows: Foreign direct investment (FDI), portfolio investments.

- Oil → CAD (Canada), NOK (Norway), RUB (Russia)

- Gold → AUD (Australia)

- Agricultural goods → NZD (New Zealand)

- Chart patterns, support/resistance levels, moving averages.

- Algorithmic and high-frequency trading amplify moves.

- Natural disasters, terrorist attacks, pandemics (e.g., COVID-19 caused massive USD strength initially).

The forex market operates 24/5, with overlapping sessions (Asia, Europe, North America). Prices react instantly to:

- News releases

- Central bank speeches

- Economic data surprises

- Global risk events

Pro Tip: The US Dollar (USD) is involved in ~88% of all forex trades, so US economic data and Fed policy often drive the entire market.

When and Where Forex Happens

Forex doesn’t have a single building or market like the stock exchange. It happens online, between people, banks, and companies all over the world. You just need an internet connection and a trading platform that’s your access to the market.

When it Happens

Forex is open 24 hours a day, five days a week. It starts on Monday morning in Asia and keeps moving around the world until Friday night in the U.S.

Think of it like a relay race when one region finishes trading, another one starts. That’s why the market almost never sleeps.

Here’s how it moves through time zones:

| Trading Session | Opens (UTC) | Closes (UTC) | Opens (EAT – Dar es Salaam) | Closes (EAT – Dar es Salaam) | What Happens |

|---|---|---|---|---|---|

| Sydney (Australia) | 10 PM | 7 AM | 1 AM | 10 AM | Market wakes up – light movement |

| Tokyo (Asia) | 12 AM | 9 AM | 3 AM | 12 PM | Asian currencies (JPY) get active |

| London (Europe) | 8 AM | 5 PM | 11 AM | 8 PM | Biggest session – lots of volume |

| New York (USA) | 1 PM | 10 PM | 4 PM | 1 AM | USD pairs move strongly |

Where it Happens

There’s no single location. Forex trading happens:

- On your computer or phone

- Through brokers who connect you to the global market

- Between traders all around the world

Forex happens everywhere, and it’s open almost all day, except weekends.

How Forex Trading Actually Works

At its core, forex trading is buying one currency and selling another at the same time because currencies are always traded in pairs.

For example:

When you trade EUR/USD, you’re comparing the Euro against the US Dollar.

- If you think the Euro will rise against the Dollar, you buy EUR/USD.

- If you think the Euro will fall, you sell EUR/USD.

Who’s Involved in Forex

- Big Banks and Institutions – They move most of the money.

- Companies – They trade currencies for business (like paying suppliers overseas).

- Governments and Central Banks – They stabilize their currency or control inflation.

- Retail Traders – People like you and me, trading through online brokers.

How You Make Money

Let’s say:

- You buy EUR/USD at 1.1000

- Later, the price rises to 1.1050

If your position size is $10 per pip, you made $500 (50 × $10).

If it went the other way, you’d lose $500.

The Trading Platform

A trading platform is the software you use to see prices, read charts, and open or close trades. Think of it as your control room for trading Forex.Most traders use MetaTrader 4 (MT4) or MetaTrader 5 (MT5) they’re free, popular, and work on phones, laptops, or browsers. Your broker usually gives you a download link when you open an account.

What You See on the Platform

When you open MT4 or MT5, you’ll see a few main parts:1. Chart Window

This shows how a currency’s price moves over time. Each “candle” or “bar” represents a time period could be one minute, one hour, or one day, depending on your setting.

You use charts to spot trends and decide when to buy or sell.

2. Market Watch

This small list shows currency pairs and their current prices.

Example:

- EUR/USD – 1.1002 / 1.1004

- GBP/USD – 1.2731 / 1.2733

The first number is the sell price (bid), and the second is the buy price (ask). The tiny difference between them is the spread that’s your broker’s small fee.

3. Terminal or Trade Tab

Here you see your open trades, account balance, profit/loss, and trade history. It’s basically your dashboard.

4. Order Panel

This is where you place new trades. You’ll choose the pair, trade size, whether you want to buy or sell, and set your Stop Loss (SL) and Take Profit (TP) levels before confirming.

Placing a Simple Trade

Let’s say you want to buy EUR/USD.- Open the Order Window.

- Choose EUR/USD.

- Type your lot size (example: 0.01 = micro lot).

- Click Buy by Market if you want to buy immediately at the current price.

- Set your Stop Loss (to limit loss) and Take Profit (to secure profit).

That’s it. You’ve opened your first trade. You can close it anytime manually or let the platform close it automatically when it hits your SL or TP.

Timeframes

You can view charts in different timeframes:- M1 = 1 minute

- M15 = 15 minutes

- H1 = 1 hour

- H4 = 4 hours

- D1 = 1 day

Shorter timeframes show quick price moves. Longer ones show the bigger picture. Most beginners start with H1 or H4 it’s calmer and clearer.

Indicators

These are tools that help you read charts. Examples:- Moving Average (MA) – shows the general trend.

- Relative Strength Index (RSI) – shows when the market might be overbought or oversold.

- MACD – shows momentum and possible reversals.

YOU CAN USE TRADING VIEW SOFTWARE FOR BETTER VIEW DOWNLOAD TRADING VIEW

Practice on Demo

Your demo account lets you use the platform with fake money.Use it to learn:

- How to open and close trades

- How to set SL and TP

- How to read charts and change timeframes

- How to test your strategy without risk

Stay on demo until you feel comfortable using every part of the platform with your eyes closed.